Mastering Financial Discipline

Title: Mastering Financial Discipline: The Art of Creating a Saving Plan

A saving plan is a structured approach to managing finances with the goal of setting aside money regularly for future needs or goals. It involves creating a systematic strategy for saving a portion of income over a specified period, typically towards specific financial objectives such as building an emergency fund, saving for a major purchase, or investing for retirement. Saving plans often involve setting clear savings goals, determining the amount to save regularly, and selecting appropriate savings vehicles or accounts to hold the funds. By following a saving plan, individuals can develop healthy financial habits, accumulate savings over time, and work towards achieving their financial goals.

https://www.highcpmgate.com/pt5u2kccc?key=a264d8fc11253218a4e25bbd8ab886a5

Introduction:

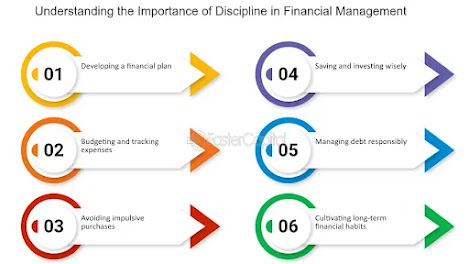

In the pursuit of financial stability and security, one of the most crucial steps individuals can take is to establish a saving plan. A saving plan serves as a roadmap for managing finances effectively, enabling individuals to allocate a portion of their income towards savings goals and future financial objectives. In this article, we delve into the importance of saving plans, key elements to consider when creating one, and practical tips for success in mastering financial discipline.

The Significance of Saving Plans:

1. Building Financial Resilience:

- A saving plan is essential for building financial resilience and safeguarding against unexpected expenses, emergencies, or income disruptions.

- By setting aside funds in advance, individuals can create a financial safety net to cover unforeseen circumstances without resorting to debt or depleting savings.

2. Achieving Financial Goals:

- Saving plans provide a structured approach to achieving financial goals, whether it's saving for a down payment on a house, funding higher education, or preparing for retirement.

- By establishing clear savings objectives and timelines, individuals can track their progress and stay motivated to reach their financial milestones.

https://www.highcpmgate.com/pt5u2kccc?key=a264d8fc11253218a4e25bbd8ab886a5

Key Elements of a Saving Plan:

1. Define Clear Savings Goals:

- Begin by identifying specific financial goals you want to achieve, such as building an emergency fund, saving for a vacation, or investing for retirement.

- Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) that outline the amount you need to save and the timeline for reaching each goal.

2. Determine Savings Targets:

- Calculate the amount you need to save regularly to achieve your financial goals within the desired timeframe.

- Consider factors such as your income, expenses, existing savings, and investment returns when determining savings targets.

3. Establish a Budget:

- Develop a budget that outlines your income, expenses, and savings allocations on a monthly or annual basis.

- Allocate a portion of your income towards savings as a non-negotiable expense, treating it with the same importance as other financial obligations.

https://www.highcpmgate.com/pt5u2kccc?key=a264d8fc11253218a4e25bbd8ab886a5

4. Choose Suitable Savings Vehicles:

- Select appropriate savings vehicles or accounts based on your goals, risk tolerance, and time horizon.

- Explore options such as high-yield savings accounts, certificates of deposit (CDs), retirement accounts (e.g., 401(k), IRA), or investment portfolios tailored to your risk profile.

Practical Tips for Success:

1. Automate Savings Contributions:

- Set up automatic transfers or direct deposits to move a predetermined amount of money from your paycheck to your savings account each month.

- Automating savings contributions ensures consistency and discipline in sticking to your saving plan.

2. Track Your Progress:

- Monitor your savings progress regularly by reviewing your budget, tracking expenses, and checking account balances.

- Use budgeting apps, spreadsheets, or financial management tools to keep track of your savings goals and milestones.

3. Adjust as Needed:

- Periodically review and reassess your saving plan to ensure it remains aligned with your financial goals, lifestyle changes, and economic conditions.

- Make adjustments to savings targets, contributions, or investment strategies as needed to stay on track towards achieving your objectives.

https://www.highcpmgate.com/pt5u2kccc?key=a264d8fc11253218a4e25bbd8ab886a5

Conclusion:

Creating a saving plan is an essential step towards achieving financial stability, security, and success. By defining clear goals, establishing a budget, choosing suitable savings vehicles, and adopting disciplined saving habits, individuals can take control of their finances and work towards realizing their dreams and aspirations. Whether you're saving for short-term needs or long-term goals, mastering financial discipline through a saving plan empowers you to build a brighter financial future and enjoy peace of mind knowing you're prepared for whatever life may bring.

Comments

Post a Comment